How to Calculate ROI on a Rental Property

Why It’s Important to Know a Property’s ROI Before Buying Real Estate

Here’s a rewritten version of the article on calculating ROI for a rental property, tailored to the Kenyan real estate market:

How to Calculate ROI on a Rental Property in Kenya 🇰🇪

Thinking of investing in a rental property in Nairobi, Mombasa, Kisumu, or other fast-growing towns? Whether you’re eyeing a studio apartment in Kilimani or a 3-bedroom in westlands, knowing how to calculate your Return on Investment (ROI) is key before signing that sale agreement.

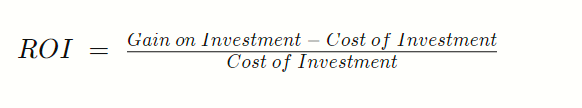

🧮 What is ROI in Real Estate?

ROI (Return on Investment) measures how profitable your rental property is. It’s expressed as a percentage and helps you decide whether a property is worth your money.

Formula:

ROI = (Annual Rental Income – Annual Expenses) ÷ Total Investment × 100

🔍 Let’s Break It Down with a Kenyan Example:

🏠 Example Property:

- Location: Kileleshwa, Nairobi

- Purchase Price: KES 12,000,000

- Furnishing : KES 500,000

- Closing costs: KES 700,000

- Total Investment: KES 13,200,000

💰 Rental Income:

- Monthly Rent: KES 95,000

- Annual Rental Income: 95,000 × 12 = KES 1,140,000

🧾 Annual Expenses:

- Service Charge: KES 7,000 × 12 = KES 84,000

- Property Management Fee (8%): 8% of 1,140,000 = KES 91,200

- Repairs & Maintenance: KES 40,000 (estimated annually)

- Land Rates & Insurance: KES 25,000

- Total Expenses: KES 240,200

✅ Now Calculate ROI:

Net Annual Profit = 1,140,000 – 240,200 = KES 899,800

ROI = (899,800 ÷ 13,200,000) × 100 = **6.81%**

📊 What is a Good ROI in Kenya?

A 6% – 10% annual ROI is generally considered good in Kenya, especially in areas like Westlands, Kilimani, Lavington, Parklands, Syokimau, or Thindigua, where rental demand is strong. Properties with unique features or close to key infrastructure like malls, schools, or the Expressway may even perform better.

🧠 Tips to Maximize Your ROI:

✅ Buy Below Market Value – Negotiate well.

✅ Furnish Smartly – A furnished apartment can command 30–50% more rent in places like Kilimani or Westlands.

✅ Keep Operating Costs Low – Use efficient property managers.

✅ Regular Maintenance – Prevent big repairs by handling issues early.

✅ Leverage Short-Term Rentals – In prime zones like Lavington or Karen, Airbnb can outperform long-term leases.

🚨 Hidden Costs to Watch Out For in Kenya:

- Stamp Duty (4%)

- Legal Fees (Approx. 1.5%)

- Valuation Costs

- Agent Commission (Usually 3%)

- Vacancy Periods – Budget for 1–2 months of possible non-occupancy each year.

📈 ROI Isn’t Everything

While ROI is a critical metric, also look at capital appreciation. Some Nairobi properties increase in value by 7–15% annually, which boosts your wealth in the long run.

🏁 Final Thought

Real estate in Kenya can be a smart investment — especially if you crunch your numbers properly. Before you commit, always ask: “How long will it take to recover my investment?”

If you’re unsure where to begin, our team at Sarabi Realty Group is here to guide you through location analysis, rental potential, and property selection.

🔎 Looking for high-ROI properties in Nairobi?

👉 Explore Our Listings

ALSO READ: Why You Should Consider The Air Bnb Business…

Other Considerations

Of course, there may be additional expenses involved in owning a rental property, such as repairs or maintenance costs, which would need to be included in the calculations, ultimately affecting the ROI.

Also, we assumed that the property was rented out for all 12 months. In many cases, vacancies occur, particularly in between tenants, and you must account for the lack of income for those months in your calculations.

ALSO WATCH: 4 bedroom all en-suite apartments with DSQ bordering Kileleshwa and lavington