As individuals seek to diversify their investment portfolios, the real estate sector is increasingly becoming a popular investment option. Investors are seeking to build generational wealth through owning diverse properties, securing their future by having retirement homes and increasing their source of revenue through renting out or selling real estate properties.

Investing in the real estate sector has been proven to be a wise financial decision, as it provides predictable cash flow, excellent returns, tax advantages, and diversification that can help in building wealth, and an even wiser decision when you choose to invest in the Kenyan market that highly values the sector.

Are you wondering whether to invest in the Kenyan real estate sector? Do you wish to invest in the Kenyan real estate sector but are unsure? Well, below are some reasons why you should choose to invest in Kenya.

Government policies and regulations

The relaxed Kenyan regulatory environment ought to encourage you to invest in the Kenyan market. The Economic Survey 2023 explains how the number of buildings that were approved by the Nairobi City County increased by 58 per cent in 2022, paving the way for increased real estate investments. There have also been efforts to push for the implementation of the Sectional Properties Act which can be used to clarify and regulate ownership of apartment and office units that have increasingly taken shape in urban areas. As an investor looking to invest in the Kenyan market, such regulations should help you cement your decision as to Why you should invest in Kenya.

Infrastructure

Investing in Kenya’s real estate is strategically sound, due to the country’s robust infrastructure development. Ongoing projects like the expansion of transportation networks, such as the Nairobi Expressway which enhances connectivity and drive property value. Improved infrastructure attracts businesses, exemplified by the completion of the Standard Gauge Railway, stimulating demand for commercial spaces. These developments position Kenya’s real estate market for substantial growth, making it an attractive investment opportunity.

Financial Benefits and prestige

The demand for housing and commercial spaces is rising, fueled by a growing middle class and urban population. As a result, property values are expected to appreciate, providing investors with attractive returns. Moreover, participating in Kenya’s real estate market can prove prestige as it aligns with the country’s vision for economic development and modernization, attracting both domestic and international attention. This combination of financial gains and prestige makes Kenya’s real estate market an enticing investment opportunity.

Security

Kenya has made significant strides in making out country a safe and secure country. There has been political stability over the years, creating a conducive environment for investment. The government’s commitment to maintaining peace and order enhances the security of property investments.

Diverse investment options

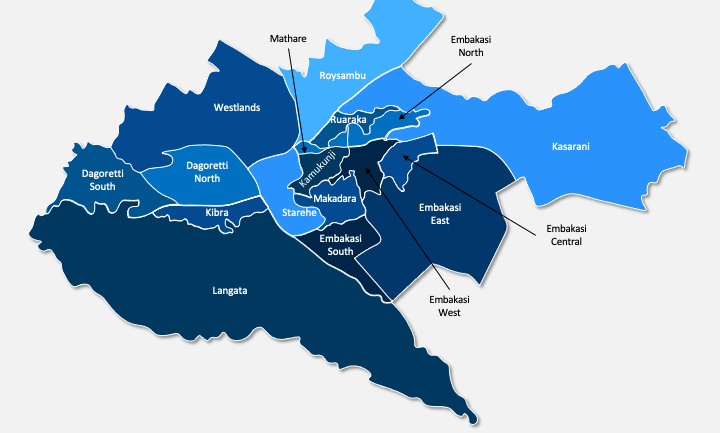

Do you wish to invest in a commercial property, or a rental property?. Investing in Kenya’s real estate market offers diverse investment options, providing investors with a robust portfolio that can mitigate risks and enhance returns. The market encompasses a wide range of properties, including residential developments, commercial spaces, and hospitality ventures. For instance, Nairobi, the capital city, presents opportunities in both high-end luxury apartments and affordable housing projects, catering to various income levels. The diversity in property types and locations not only spreads risk but also allows investors to capitalize on different market segments, contributing to a well-rounded and resilient investment strategy.

Are you convinced to invest in Kenya? Sarabi Realty Group offers you real estate opportunities worth investing in. Visit https://sarabirealtygroup.co.ke/ to get in touch with your investment partner of choice.

We have amazing Real Estate content on our Youtube Channel, Click the videos below to watch;