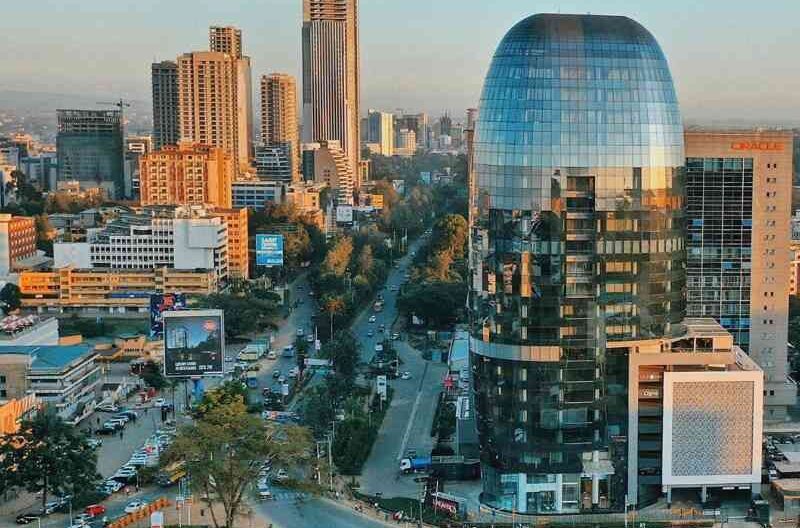

Is Buying Property in Nairobi Worth It in 2025? Investment Outlook & Expert Guide

Nairobi, the capital of Kenya, continues to evolve into a major investment hub for local and international real estate buyers. As urbanization, infrastructure growth, and a rising middle class reshape the city, many investors ask: “Is buying property in Nairobi still worth it?” This article breaks down the economic trends, location dynamics, and potential returns investors can expect in 2025 and beyond.

1. Nairobi Real Estate Investment Overview:

Nairobi’s real estate market has shown consistent growth over the past decade. Despite economic slowdowns during the COVID-19 era, the market has rebounded, supported by:

- Improved infrastructure (expressways, bypasses, SGR)

- Political stability

- Young, upwardly mobile population

- Increased diaspora remittances

- Urban expansion into satellite towns

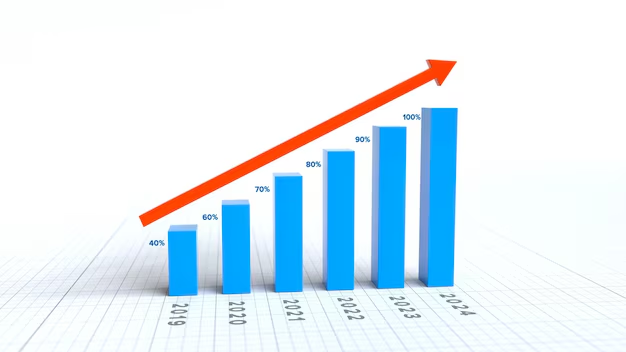

2025 Market Trends:

| Metric | 2024 | 2025 Forecast |

|---|---|---|

| Property Appreciation | 6.8% average | 10% projected |

| Rental Yield | 5–8% | 10-11% |

| Mortgage Uptake | Low | Moderate growth (due to lower rates & Fintech) |

2. Best Investment Zones in Nairobi (2025)

a. Kilimani:

Perfect for luxury rentals and Airbnb. High rental yields due to expat population and proximity to CBD and malls.

b. Westlands:

Great for commercial and residential property. Major developments ongoing, such as Global Trade Centre and Chiromo Lane growth.

c. Lavington & Kileleshwa:

Low-density, ideal for high-end family homes. Attractive to long-term renters.

d. Satellite Towns (Ruaka, Syokimau, Kitengela, Athi River):

Affordable land and apartments. Ideal for capital gains in 5–10 years.

3. Types of Properties to Buy

| Type | Ideal For | Average Cost (2025) | ROI Potential |

|---|---|---|---|

| Off-plan Apartments | First-time & diaspora investors | KES 4–15M | High if developer is reputable |

| Ready Units | Families & Buy-to-let | KES 8–30M | Stable, immediate income |

| Land (Serviced Plots) | Long-term investors | KES 2–20M | Very high over 10 years |

| Commercial Spaces | SMEs & businesses | Varies | Strong but needs strategic location |

4. Legal & Financial Considerations

- Title Search: Always confirm ownership at the Ministry of Lands.

- Zoning Laws: Check county regulations for land use.

- Stamp Duty: Typically 4% for urban property.

- Lawyer Fees: About 1.5% of transaction value.

- Capital Gains Tax: 5% of net gains from sale.

5. Is It Better to Buy or Build in Nairobi?

- Buy: Preferred for quick move-in, secure titles, and flexible payment plans.

- Build: More control and often cheaper long-term, but requires land ownership, time, and permits.

Bonus Tip: Consider gated communities or mixed-use developments for security, infrastructure, and lifestyle amenities.

Conclusion:

Yes—buying property in Nairobi is still worth it in 2025, especially if you do proper due diligence and focus on growing zones. Whether you’re buying for residence, rental income, or future resale, the city’s long-term fundamentals make it one of Africa’s strongest property markets.